Non-Performing Loans (NPL) – Fintech Solution

Non-performing loans (NPL) are often seen as toxic baggage on a bank balance sheet. But underneath their troubled surface lies a powerful, overlooked asset class waiting to be activated. When approached with the right tools, NPLs can be transformed from a burden into a new engine for growth, liquidity, and even profit. Unlike traditional systems, which struggle to manage these distressed debts, the Fintech space opens the door to smarter, faster, and more transparent ways to bring non-performing loans back into the economic cycle.

What are Non-Performing Loans?

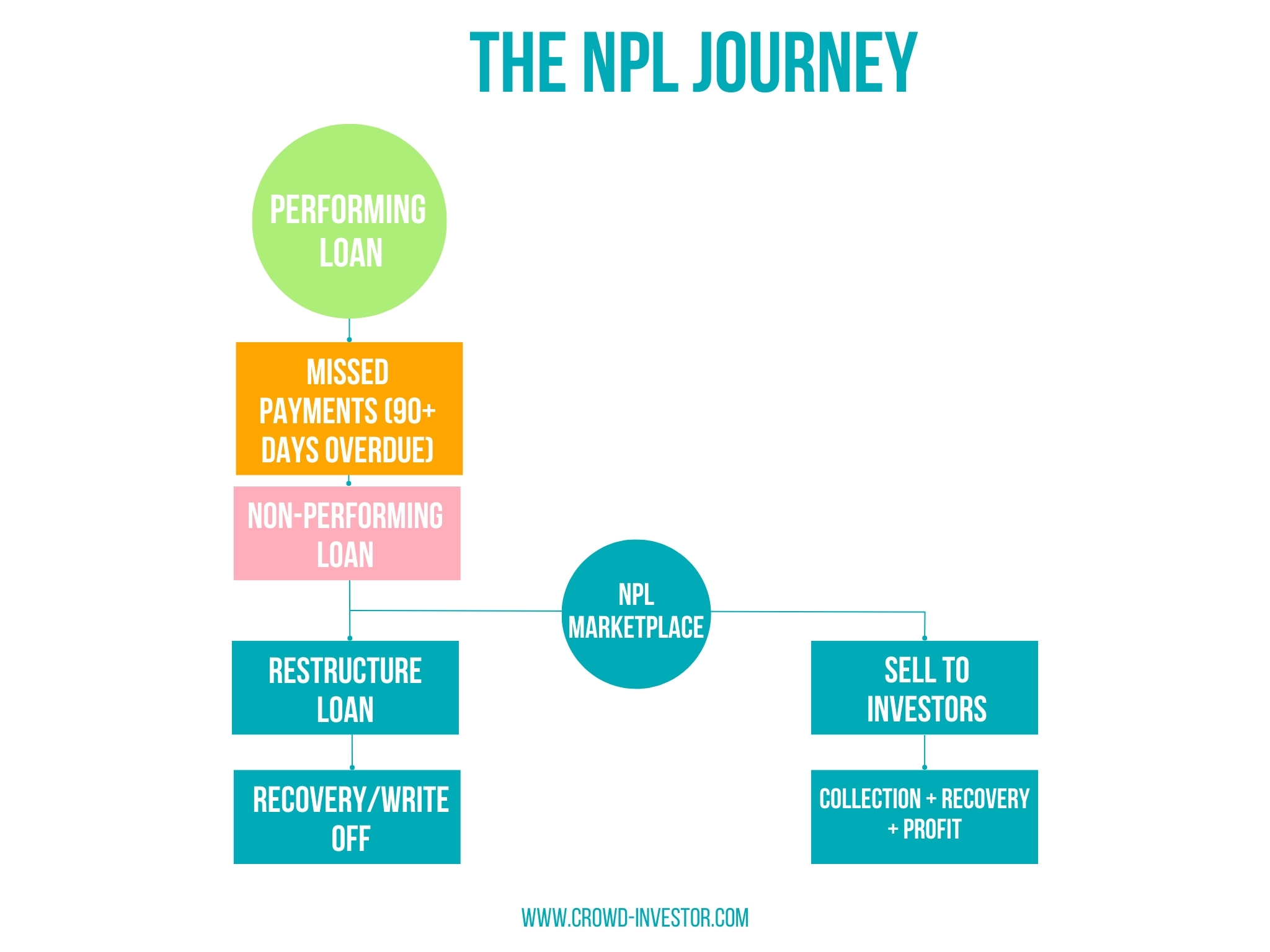

Non performing loans, often referred to as NPLs, are loans where the borrower or debtor has stopped making regular payments for a certain period, usually 90 days or more. Essentially, the money lent is not coming back on time, or not at all. For banks and financial institutions, this means the loan has gone off track, creating uncertainty about whether it will ever be repaid. But while they might look like trouble on the surface, NPLs also represent an asset that only needs a better way to be handled, priced, and traded.

How Do Non-Performing Loans Work?

Nonperforming loans start like any other loan. The money is lent out, and the borrower agrees to repay it over time with interest. But if they stop making payments, typically for 90 days or more, the loan is then qualified as non-performing.

At this point, the loan stops generating income, which is why it becomes a problem for the lender, whether it’s a bank or any other financial institution. The lenders can try to recover the money by renegotiating the terms (extending the deadline or lowering the payments) or taking legal action, but the odds that the borrower or debtor will repay the debt are significantly lower at that stage. For that reason, the lenders opt for a more convenient option, which includes selling the loan to someone else at a discount.

Now, the inevitable question pops up:

Why would someone want to buy a bad loan?

Because the loan still has value, even though the borrower hasn’t paid yet.

A debt collector, asset manager, or investor might believe they can recover more than what they paid for it. That’s where nonperforming loans become part of a larger market, where a tech-driven solution can make the process more efficient, transparent, and accessible.

NPL Marketplace – a new Fintech solution

Non-performing loans have always been hard to value, and even harder to sell in outdated processes. But the disruptive nature of Fintech is changing that narrative. By introducing smart platforms, advanced pricing models, auction-based opportunities, and automated workflows, technology is making it faster and easier to match NPL sellers with qualified buyers. What used to take months of manual due diligence, paperwork, and futile negotiations can now happen in days, or even hours, with greater transparency and trust.

As of today, ZWEBB Fintech and Stage11 are the only platform providers on the market that offer NPL marketplace as a SaaS solution.

In this new landscape, bad loans are not risks – they are assets that can be priced, packaged, and passed on with efficiency and confidence.

In a nutshell, it is a win-win for all sides.